IAC (IAC)·Q4 2025 Earnings Summary

IAC Q4 2025: Digital Transformation Delivers 14% Growth as Diller Doubles Down

February 4, 2026 · by Fintool AI Agent

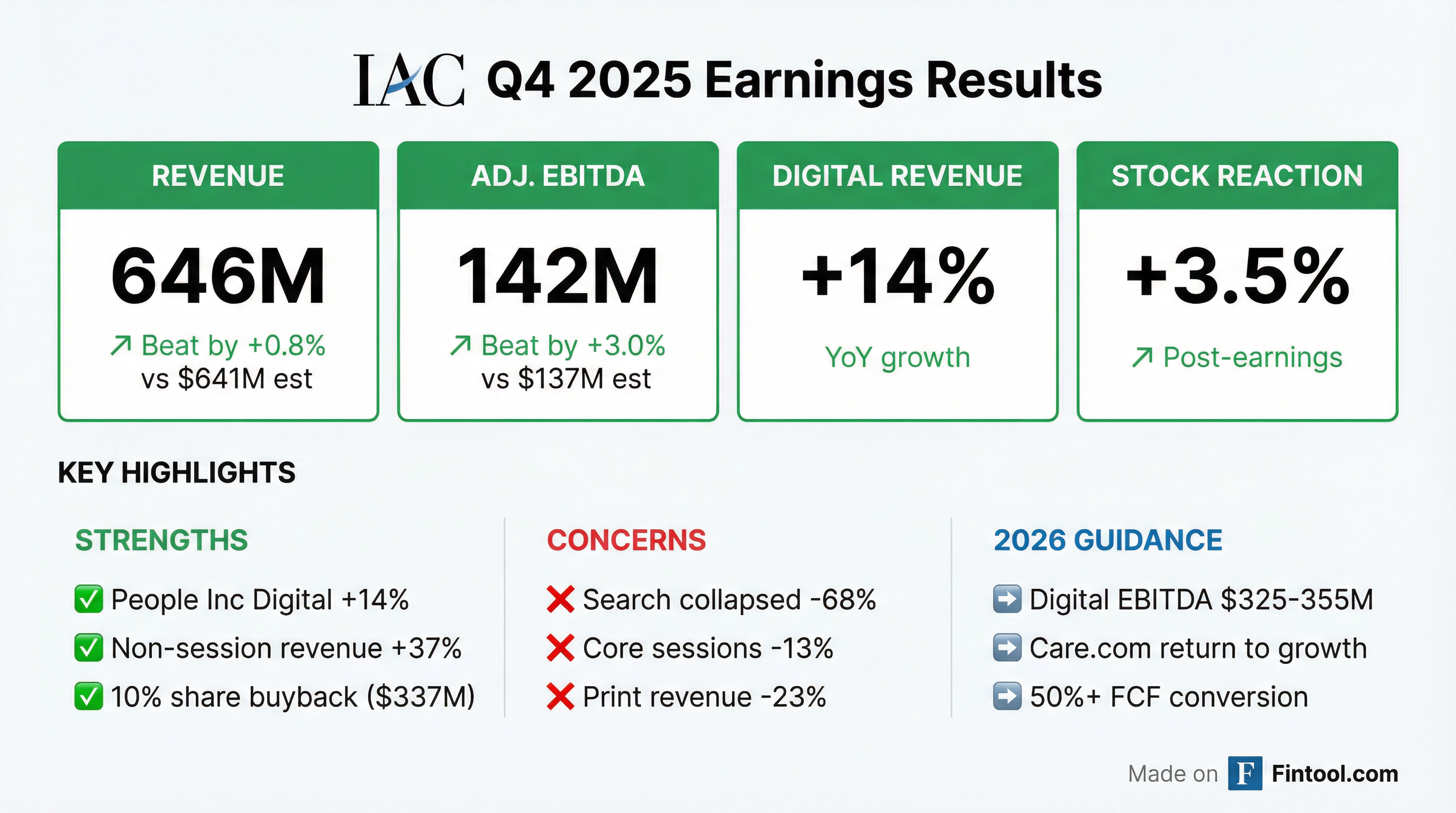

IAC delivered a confident Q4 2025 with Adjusted EBITDA of $141.6M (+3% beat) as People Inc.'s digital pivot accelerated, posting 14% digital revenue growth despite a 13% decline in core web sessions . The stock rose 3.5% to $38.22 following the call, as Chairman Barry Diller offered his most bullish commentary yet on the business.

"I would be very disappointed if People did not exceed that number," Diller said of the mid-to-high single-digit guidance, adding: "People has momentum. That machine is so well run."

Did IAC Beat Earnings?

IAC beat on both top-line and profitability metrics. The company repurchased 10% of shares outstanding ($337M) over the past 12 months and added to its MGM stake .

What's Driving the Digital Transformation?

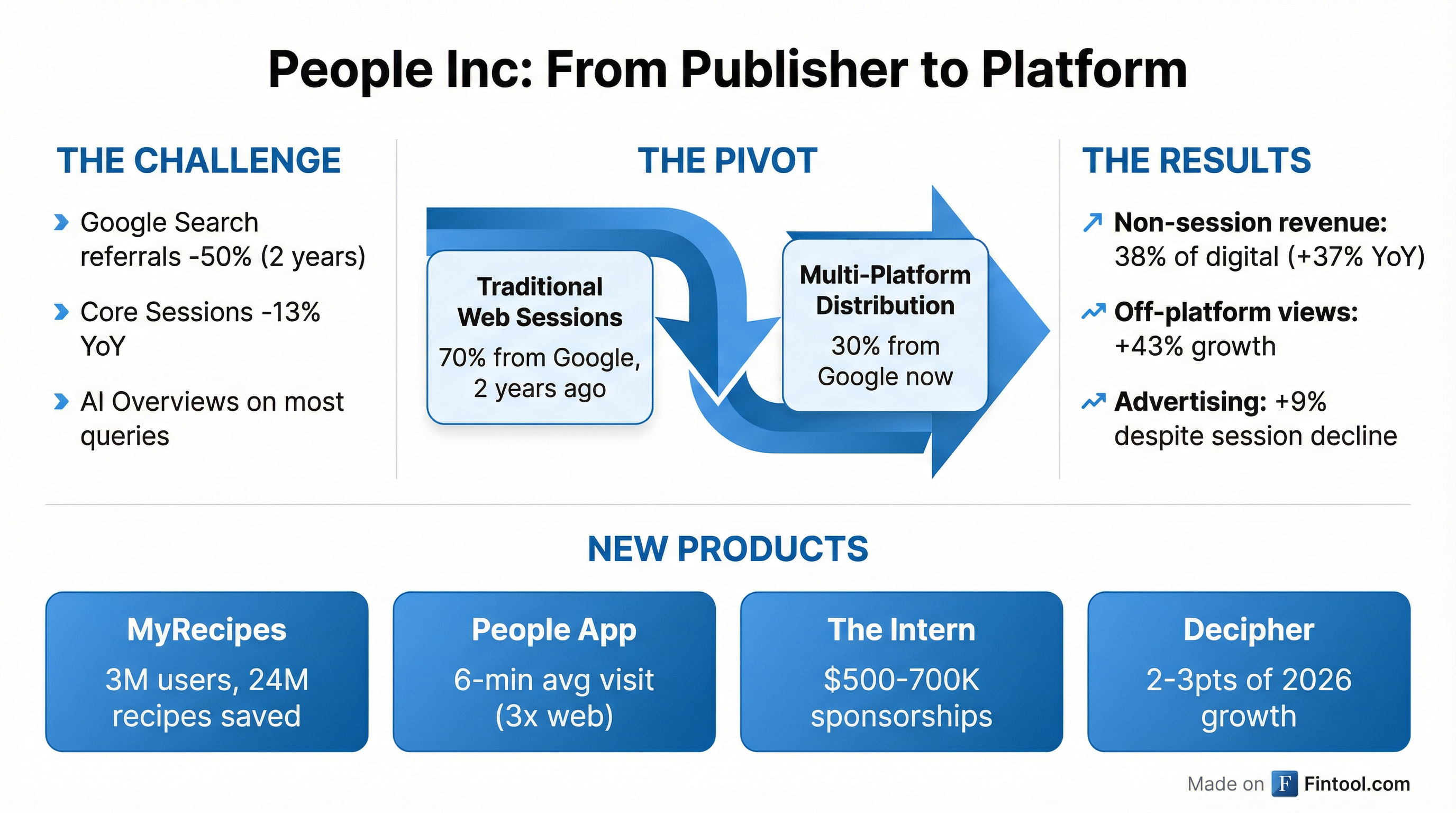

People Inc.'s strategy of "going where the audiences are" is paying off. CEO Neil Vogel explained the magnitude of the shift: Google Search referrals have dropped 50% over the past two years, from 70% of traffic to just 30% .

Digital Revenue Breakdown

Key drivers of growth:

- Non-session-based revenue now 38% of digital, growing 37% YoY

- Off-platform views nearly doubled in two years, up 43% last quarter

- Meta AI partnership signed as first lifestyle publisher

- Decipher expected to contribute 2-3 points of growth in 2026

What New Products Are Working?

Management highlighted significant traction across new consumer products:

MyRecipes

- 3 million registered users in under a year with minimal marketing

- 24 million recipes saved

- "There is no Google between us and these audiences" — Neil Vogel

People App

- 300,000 downloads with limited marketing spend

- 6-minute average visit vs. 2-minute web visits (3x engagement)

- 20-minute duration for users who play games in the app

- "The People app can eventually be the hub of the entire People brand" — Neil Vogel

The Intern (InStyle)

- Social-first video series capturing "Gen Z zeitgeist"

- Sponsorships grew from $50-80K to $500-700K per season

- 7 seasons produced last year, each with 6 three-minute episodes

- "Done in-house, basically on an iPhone" — Barry Diller

What Did Management Say About Strategy?

Barry Diller outlined a vision to "invert" content businesses into consumer products:

"We're in the process of inverting these iconic traditional content businesses into entirely new consumer businesses, products that stand on their own and revenue streams with stronger immunity against disintermediation."

Specific initiatives announced:

- Southern Living: Launching "Southern Living's Southern Living" as a physical product line

- Food & Wine: Organizing a "best chefs" product line leveraging their culinary expertise

- Travel and Leisure: "We're gonna do our own White Lotus" — destination experiences

With 350 million+ magazines distributed annually, Diller sees this as a unique distribution advantage: "Adding a page, 2 pages, 3 pages costs virtually nothing. So we can sell through in unique ways almost anything that no one else can do."

What Happened to the Search Business?

The Search segment collapsed 68% to $29M, with Ask Media Group down 71% .

Management was blunt about the outlook: "The outcome of those negotiations will likely determine the future of the business."

The Google service agreement expires March 31, 2026, and management expects "to know a lot more over the next 90 days."

What Did Management Guide?

IAC announced it will stop providing quarterly guidance to focus teams on long-term execution rather than short-term metrics .

FY 2026 Guidance

Key guidance details from the call:

- Digital EBITDA: $325-355M expected vs. $315M in 2025

- Free cash flow conversion: 50%+ of EBITDA

- CapEx: $20-30M

- Net interest expense: ~$64M

- Google litigation expense: ~$15M

CFO Christopher Halpin explained the apparent flat guidance: "There are two key countervailing trends... mid- to high single-digit EBITDA growth off the $315M [digital], offset by a $31M net swing from the relationship between print and corporate."

What's the MGM Investment Thesis?

Barry Diller provided his most detailed explanation of the MGM stake:

"We bought the stock at... $1.3 billion. It's valued at $2.2 billion. So that's the answer. That's not the full answer."

Key MGM thesis points:

- Las Vegas infrastructure: "40% of Las Vegas is owned by MGM. The infrastructure can never be duplicated."

- Innovation potential: "Every piece of what they do is something you can iterate on... without huge amounts of capital."

- Japan opportunity: $12B resort development in Osaka opening 2029-30 — "gonna be one of those golden assets"

- BetMGM turnaround: From ~$170M loss to $170M profit — "That is a turn... Nobody pays attention to it. I truly don't get it."

On future M&A: "Right now, I really don't see anything at a price that would be rational to pay... I like the hand we have right now."

On CNN: "Less than 50/50. I'll get the opportunity... If it happened, it would be on the personal side, not through IAC."

How Is Care.com Performing?

Care.com saw 9% revenue decline in Q4, driven by enterprise softness .

Leadership change: Bill Kong (former COO) was named CEO, replacing founder Parth Bhakta who moved to Chairman .

Long-term outlook: "Care should be growing 15%-20%, given its market position... and the ever-increasing need for care, both for consumers... and employers who increasingly view it as a base benefit."

How Did the Stock React?

IAC shares rallied +3.5% to $38.22 on the earnings call, reversing pre-market weakness.*

*Values retrieved from S&P Global

The positive reaction reflects investor confidence in People Inc.'s digital transformation and Diller's bullish tone, despite ongoing headwinds in Search and Care.

What's the Ad Market Like?

Neil Vogel rated the advertising environment "6 out of 10" — "healthy, remained generally favorable in Q4, pretty solid for us."

Strong sectors: Health & pharma, travel, tech

Weak sectors: Food & beverage, CPG — "has been very challenged"

On competitive positioning: "Brands matter, and in an AI world where everything is uncertain... the strength of brands really resonates."

Capital Allocation Update

Forward Catalysts

Near-term (Q1-Q2 2026):

- Google Search contract resolution (March 31 deadline)

- Care.com revenue growth inflection (mid-year target)

- Q1 2026 earnings (May 2026)

Medium-term:

- Decipher revenue acceleration

- New product launches (Southern Living, Food & Wine, T&L)

- AI partnership monetization (Meta, OpenAI, Microsoft)

Long-term:

- MGM Japan resort opening (2029-30)

- MGM capital returns / potential monetization

- BetMGM profitability trajectory

Key Takeaways

-

Digital transformation is working: 14% digital revenue growth despite 13% session decline proves the "go where the audiences are" strategy is succeeding

-

Diller is bullish: Rare public statement that he'd be "very disappointed" if People doesn't exceed guidance signals confidence

-

Search is being managed for exit: "The outcome will likely determine the future of the business" — not a core asset

-

MGM is a conviction bet: $1.3B → $2.2B, with Japan and BetMGM as long-dated catalysts

-

New products showing traction: MyRecipes, People App, and The Intern demonstrate ability to build direct consumer relationships